Schedule E 2024 Tax Form

Schedule E 2024 Tax Form – For instance, e-filers who submit between January 23 It’s important to note that the IRS Tax Refund Schedule 2024 lists additional conditions that may affect the timing of tax refunds . There’s a lot to keep track of for tax season this year. Here’s what you need to know about checking your refund status, getting your money quickly and making sure you don’t miss any deadlines in 2024 .

Schedule E 2024 Tax Form

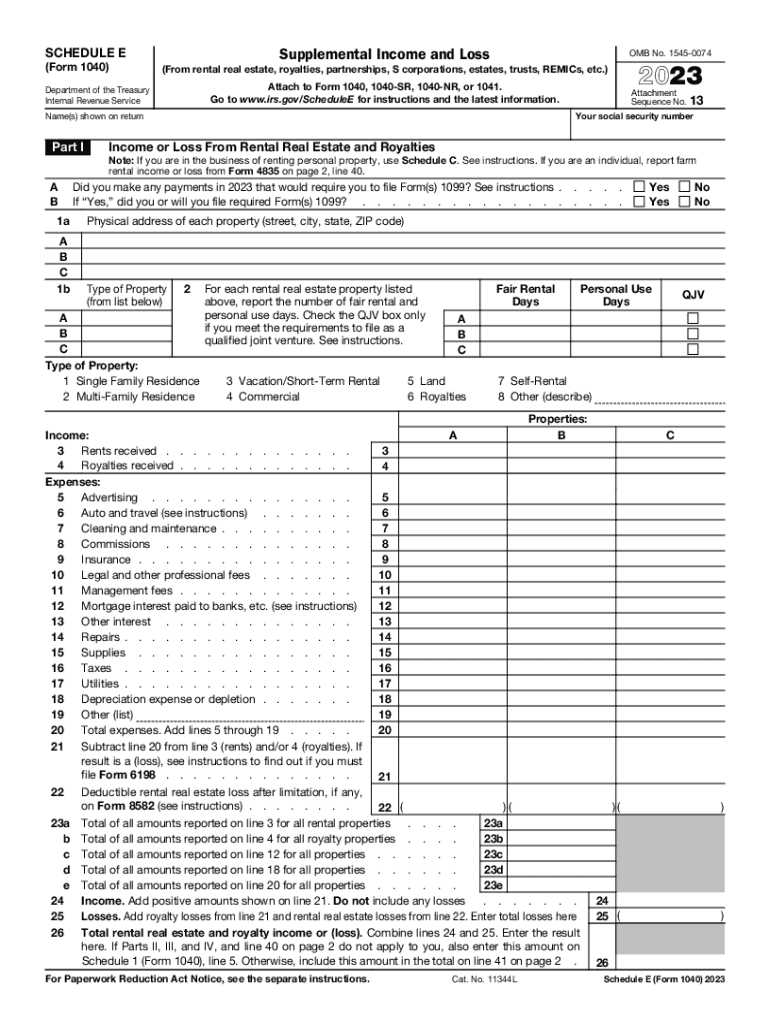

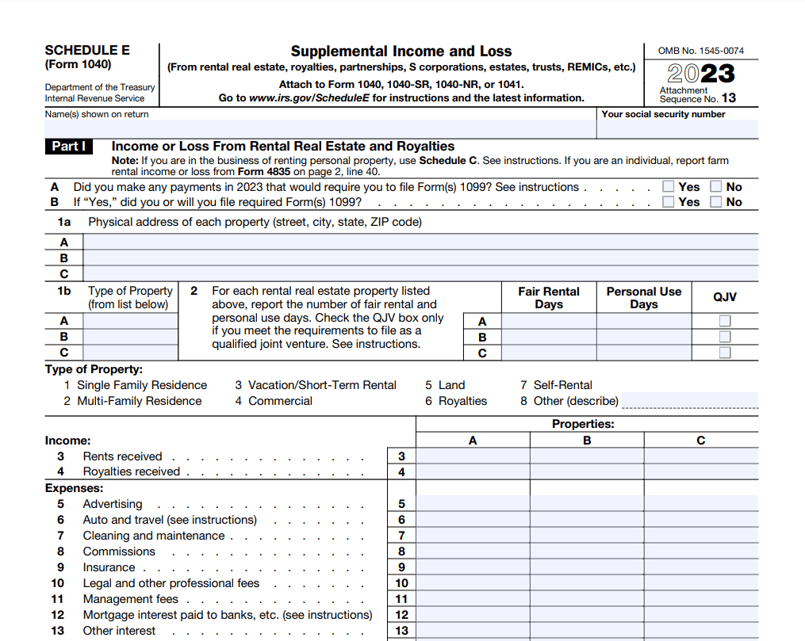

Source : www.inkle.io2023 Form IRS 1040 Schedule E Fill Online, Printable, Fillable

Source : irs-form-schedule-e.pdffiller.comThe 2024 Ultimate Guide to IRS Schedule E for Real Estate Investors

Source : www.therealestatecpa.com2024 IRS Refund Schedule, E File & Paper Filing Dates

Source : www.inkle.ioMastering Schedule E: Tax Filing for Landlords Explained

Source : www.turbotenant.comThe 2024 Ultimate Guide to IRS Schedule E for Real Estate Investors

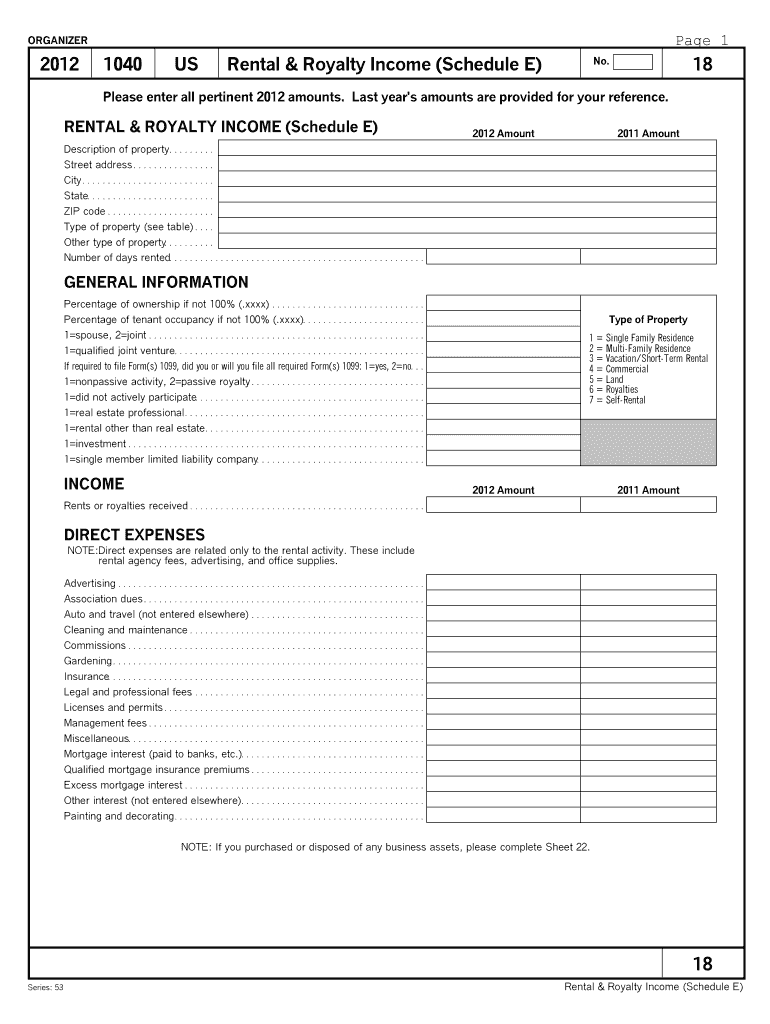

Source : www.therealestatecpa.comIRS 1040 Schedule E 2022 2024 Fill and Sign Printable Template

Source : www.uslegalforms.comTax Forms For 2024 Tax Returns Due in 2025. Tax Calculator

Source : www.efile.comWhen To Expect My Tax Refund? IRS Refund Calendar 2024

Source : thecollegeinvestor.comSchedule e tax form: Fill out & sign online | DocHub

Source : www.dochub.comSchedule E 2024 Tax Form 2024 IRS Refund Schedule, E File & Paper Filing Dates: By law, the IRS must wait until at least mid-February to issue refunds to taxpayers who claimed the earned income tax credit or additional child tax credit. According to the agency, those payments . This involves gathering essential tax documents like W-2s or 1099 forms 15, 2024. Late returns are accepted via e-file until November. “Understanding the estimated tax refund schedule .

]]>